| ☒ | Preliminary Proxy Statement | |

| ☐ | ||

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | ||

| Definitive Proxy Statement | |

| ☐ | ||

| Definitive Additional Materials | |

| ☐ | ||

| Soliciting Material Pursuant to 240.14a-12 |

| ☒ | No fee required | |

| ☐ | ||

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| Fee paid previously with preliminary materials. | |

☐ |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act 14a-6(i)(1) and |

|

| |

|

| |

|

| |

|

0-11 | |

CHURCH & DWIGHT CO., INC.

Virtually via a live audio webcast at www.virtualshareholdermeeting.com/CHD2024 CHURCH & DWIGHT CO., INC. Princeton South Corporate Park 500 Charles Ewing Boulevard Ewing, New Jersey 08628 USA (609) 806-1200 www.churchdwight.com | ||

| ||

Notice of Annual Meeting of Stockholders to be held Thursday, May 3, 2018.2, 2024

The Annual Meeting of Stockholders of Church & Dwight Co., Inc. will be held at Church & Dwight Co., Inc., Princeton South Corporate Park, 500 Charles Ewing Boulevard, Ewing, New Jersey 08628 on Thursday, May 3, 20182, 2024 at 12:00 p.m., Eastern Daylight Time,Time. To support the health and well-being of our employees and stockholders, and to facilitate stockholder attendance and ability to participate fully and equally from any location around the world at no cost, this year’s meeting will be held virtually via a live audio webcast at www.virtualshareholdermeeting.com/CHD2024. At the meeting stockholders will be asked to consider and take action on the following:

1. | Election of |

2. | An advisory vote to approve the compensation of our named executive officers; |

3. |

|

| Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for |

| 4. | A proposal to amend our Amended and Restated Certificate of Incorporation; and |

5. | Transaction of such other business as may properly be brought before the meeting or any adjournments thereof. |

All stockholders are cordially invited to attend, although only those stockholders of record as of the close of business on March 6, 20182024 will be entitled to notice of, and to vote at, the meeting or any adjournments thereof.

Your vote is important. Whether or not you expect to attend the virtual meeting, we urge you to vote by submitting your proxy. You may vote your proxy four different ways: by mail, via the Internet, by telephone, or in person atduring the virtual meeting. Please refer to detailed instructions included herein or with the Notice Regarding the Availability of Proxy Materials.

By Order of the Board of Directors,

PATRICK D. DE MAYNADIER Corporate Secretary |

Ewing, New Jersey

March 23, 201822, 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD VIRTUALLY ON MAY 3, 2018: 2, 2024: The Notice of Annual Meeting, Proxy Statement and 20172023 Annual Report to Stockholders are available at: https://materials.proxyvote.com/171340.

TABLE OF CONTENTS | ||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 3 | |||

| 5 | |||

| 5 | |||

| 9 | |||

| 20 | |||

| 20 | |||

CORPORATE GOVERNANCE GUIDELINES AND OTHER CORPORATE GOVERNANCE DOCUMENTS |

| 20 | ||

| 20 | |||

| 21 | |||

| 21 | ||||

| 21 | ||||

| 21 | |||

| 23 | |||

| 24 | ||||

| 25 | ||||

| 26 | |||

| 30 | |||

| 30 | ||||

| 31 | ||||

| 31 | |||

| 34 | |||

| 36 | |||

| 37 | |||

| 37 | |||

SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

| 40 | ||

| 43 | |||

| 43 | |||

| 43 | |||

| 44 | |||

| 45 | |||

| 46 | |||

| 47 | |||

| 47 | |||

| 47 | ||||

| 49 | |||

|

| 51 | ||

| 51 | |||

| 52 | ||||

| 52 | |||

| 52 | |||

| 53 | ||||

| 55 | ||||

| ||||

| 56 | |||

| 57 | |||

| 57 | ||||

| Church & Dwight Co. | 2024 Proxy Statement |

| TABLE OF CONTENTS | ||

| 58 | ||||

| 58 | |||

| 59 | |||

| 59 | ||||

| 59 | |||

| 59 | |||

| 59 | |||

|

| |

|

| 94 | ||||

| A-1 | ||||

| Church & Dwight Co.| |

|

PROXY STATEMENTSTATEMENT SUMMARY

This summary highlights important information you will find in this proxy statement. This summary does not contain all of the information you should consider. You should read the complete proxy statement and our 20172023 Annual Report before voting.

In this proxy statement, the words “Church & Dwight,” “Company,” “we,” “our,” “ours,” and “us” and similar terms refer to Church & Dwight Co., Inc. and its consolidated subsidiaries.

20182024 ANNUAL MEETING OF STOCKHOLDERS

| Date and Time: |

| May |

| Place: | Virtually via a live audio webcast at www.virtualshareholdermeeting.com/CHD2024 | |

| Record Date: |

| March 6, 2024 |

Princeton South Corporate Park

500 Charles Ewing Boulevard

Ewing, New Jersey 08628

|

|

|

|

VOTING MATTERS AND BOARD OF DIRECTORS RECOMMENDATIONS

| Proposals | Board Recommendation | Vote | Required | ||||

|

| ||||||

| Election of | FOR EACH NOMINEE | Majority of votes cast | ||||

| Advisory vote to approve the compensation of our named executive officers |

| FOR | Majority of votes present | |||

|

|

|

| ||||

| Ratification of the appointment of Deloitte & Touche LLP as our |

| FOR | Majority of votes present | |||

4. | Approve a proposal to amend our Amended and Restated Certificate of Incorporation | FOR | Majority of votes outstanding and entitled to vote | ||||

Church & Dwight Co. | 2024 Proxy Statement | 1 | |

| SUMMARY | ||

Bradlen S. Cashaw, Matthew T. Farrell, Bradley C. Irwin, Penry W. Price, Susan G. Saideman, Ravichandra K. Saligram, Robert K. Shearer, Janet S. Vergis, Arthur B. Winkleblack, and Laurie J. Yoler are the nominees to serve as all of the members of the Company’s Board of Directors (“Board” or “Board of Directors”) until our 20212025 Annual Meeting of Stockholders. Detailed information about all of our directors’ and director nominee’snominees’ backgrounds and areas of expertise can be found beginning on page 7.under “Proposal 1: Election of Directors – Skills and Qualifications of our Board of Directors.”

|

|

|

| Committees | |||||||||||||||||

| Name | Position | Director Since | Independent | Audit | Compensation and Human | Governance, Nominating and Corporate Responsibility | Executive | ||||||||||||||

| Bradlen S. Cashaw | Chief Operating Officer, Agropur | 2021 | X | X |

| X |

|

| |||||||||||||

| |||||||||||||||||||||

|

|

|

|

|

|

|

| ||||||||||||||

Matthew T. Farrell | Chairman of the Board, President and Chief Executive Officer, Church & Dwight | 2016 |

|

|

|

|

| ||||||||||||||

| Chair | ||||||||||||||||||||

| Bradley C. Irwin | Retired President and Chief Executive Officer, Welch Foods, Inc. | 2006 | X |

| X | X |

|

| |||||||||||||

| Penry W. Price |

| 2011 | X | X | Chair | X | |||||||||||||||

| Susan G. Saideman | Founder and Chief Executive Officer, Portage Bay Limited LLC and former Vice President, Amazon, Inc. |

| 2020 | X | X |

|

|

| X |

| |||||||||||

| Ravichandra K. Saligram | Retired Chief Executive Officer, Newell Brands, Lead Director, Church & Dwight Co., Inc. | 2006 | X |

| X | X | X | ||||||||||||||

| Robert K. Shearer | Retired Senior Vice President and Chief Financial Officer, |

|

|

| X | X |

|

|

| ||||||||||||

|

|

| |||||||||||||||||||

| Janet S. Vergis | Former Executive Advisor for private equity firms and former CEO, OraPharma, Inc. | 2014 | X | X | Chair | X | |||||||||||||||

| Arthur B. Winkleblack | Retired Executive Vice President and Chief Financial Officer, HJ Heinz Company | 2008 | X | Chair | X | ||||||||||||||||

| Laurie J. Yoler | Partner, Playground Global |

| 2018 | X |

| X | X |

| |||||||||||||

2

|

|

|

|

| SUMMARY | ||

(1)If elected to the Board, Ms. Yoler will be appointed to the Compensation & Organization and Governance & Nominating committees.

|

| |

|

CORPORATE GOVERNANCEGOVERNANCE

We strive to maintain effective corporate governance practices and policies. We believe that the following practices and policies contribute to our strong governance profile:

Director Independence |

|

| 9 of 10 | |

| ◾ | 3 fully independent Board committees: Audit, Compensation & | ||

| ◾ | Independent Lead Director presides over executive sessions of, | ||

Board Accountability |

| ◾ | Annual election of directors | |

| ◾ | Our directors are subject to “majority | |||

Board Leadership |

| ◾ | Annual assessment and determination of Board leadership structure | |

| ◾ | Annual | ||

| ◾ | Lead Director has strong role and significant governance duties, including approval of Board agendas and chairing executive sessions of all independent directors | ||

Board Evaluation and Effectiveness |

| ◾ | Annual Board, Committee, and individual director evaluations | |

Board Refreshment |

| ◾ | Existing Board members | |

| ◾ | Annual review of board succession plans | ||

Director Engagement |

| ◾ | Each director attended at least | |

| ◾ | Board policy limits director membership to four other public company boards for non-employee directors (without the approval of the Governance, Nominating & | ||

| ◾ | Stockholder ability to contact directors (as described | ||

Director Access and Resources |

| ◾ | Significant interaction with the Company’s senior business leaders through regular business reviews | |

| ◾ | Directors have direct access to senior management and other employees | ||

| ◾ | Directors have authorization to hire outside experts and consultants and to conduct independent investigations | ||

Proxy Access | ◾ | Our Bylaws provide for proxy access by stockholders | ||

No Supermajority Voting Requirements | ◾ | No supermajority requirement for stockholders to amend Bylaws | ||

| ◾ | No supermajority requirement for stockholders to amend the Certificate of Incorporation | |||

Right of Stockholders to Request Special Meeting | ◾ | Stockholders with at least 25% of our outstanding stock have the right to request special meetings of the stockholders | ||

Clawback |

| ◾ | Clawback | |

| ◾ | Clawback provisions incorporated into the Company’s | |||

Anti-Hedging Policy | ◾ | Insider trading policy prohibits non-employeedirectors | ||

Church & Dwight Co. | 2024 Proxy Statement | 3 | |

| SUMMARY | ||

Share Ownership | ◾ | CEO is required to hold shares equivalent to 6x base salary | ||

| ◾ | CFO is required to hold shares equivalent to 3x base salary | |||

| ◾ | All other senior executives are required to hold shares equivalent to 2.5x base salary | |||

| ◾ |

| ||

Director Compensation | ◾ | Implemented a maximum annual limit of $750,000, in the aggregate, for Director Compensation | ||

Compensation Practices | ◾ | Target compensation opportunities are competitive in markets in which we compete for management talent | ||

| ◾ | Use of short-term and long-term incentives ensure a strong connection between Company performance and actual compensation realized | |||

| ◾ | Our Annual Incentive Plan utilizes five diverse metrics to avoid over-emphasis on any one measure | |||

| ◾ | In the event of a change in control, our named executive officers will not receive cash severance, nor will equity granted after July 30, 2019 vest, unless accompanied by a qualifying termination of the named executive officer | |||

| ◾ | No excise tax gross-ups for | |||

| ◾ | No defined pension benefit plan or similarly actuarially valued pension plan for executives | |||

| ◾ | Limited perquisites | |||

| ◾

| Repricing of stock options is prohibited without prior stockholder approval | |||

| ◾ | Commitment to building a diverse | ||

Risk Management/ESG | ◾ | Risk assessment and risk management are the responsibility of the Company’s management, and the Board has oversight responsibility for those processes and findings | ||

| ◾ | The Board and its committees oversee the execution of the Company’s sustainability strategy and its environmental, social and governance priorities and initiatives as part of their oversight of the Company’s overall strategy and risk management | |||

4

| ||

Church & Dwight Co.| | | |

PROXY STATEMENT | ||

Princeton South Corporate Park, 500 Charles Ewing Boulevard, Ewing, New Jersey 08628

(609) 806-1200

INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

This proxy statement is furnished in connection with the solicitation of proxies by our Board for use at the 20182024 Annual Meeting of Stockholders (the “Annual Meeting”) to be held virtually on May 3, 20182, 2024, and at any adjournments thereof.

Who Can Vote

Each holder of record of our common stock at the close of business on March 6, 20182024, is entitled to vote at the Annual Meeting. At the close of business on March 6, 2018,2024, there were 244,126,653243,904,772 shares of our common stock outstanding.

Distribution of Proxy Solicitation and Other Required Annual Meeting Materials

The rules of the Securities and Exchange Commission (“SEC”) has adopted rules that allow us to mail a notice to our stockholders advising that our proxy statement, annual report to stockholders, electronic proxy card, and related materials are available for viewing, free of charge, on the Internet. These rules give us the opportunity to serve you more efficiently by making the proxy materials available quickly online and reducing costs associated with printing and postage. Stockholders may access these materials and vote over the Internet or by telephone or request delivery of a full set of materials by mail or email. We have elected to utilize this process for the Annual Meeting. We began mailing the required notice, called a Notice Regarding Availability of Proxy Materials (“Notice”), to stockholders on or about March 23, 201822, 2024. The proxy materials have been posted on the Internet, at https://materials.proxyvote.com/171340. If you received a Notice by mail, you will not receive a paper or email copy of the proxy materials unless you request one in the manner set forth in the Notice.

How You Can Vote

You may vote by any of the following methods:

In person. Stockholders of record and beneficial stockholders with shares held in street name (held in the name of a broker or other nominee) may vote in person at the Annual Meeting. If you hold shares in street name, you must obtain a legal proxy from your broker or other nominee to vote in person at the Annual Meeting.

| • | During the virtual Annual Meeting. Stockholders of record and beneficial stockholders with shares held in street name (held in the name of a broker or other nominee) may vote virtually during the Annual Meeting. If you hold shares in street name, you must obtain a legal proxy from your broker or other nominee to vote virtually during the Annual Meeting. |

By telephone or via the Internet. You may vote by proxy, either by telephone or via the Internet, by following the instructions provided in the Notice, proxy card, or voting instruction card.

| • | By telephone or via the Internet. You may vote by proxy, either by telephone or via the Internet, by following the instructions provided in the Notice, proxy card, or voting instruction card. |

By mail. If you request printed copies of the proxy materials by mail, you may vote by proxy by signing and returning the proxy card or voting instruction card.

| • | By mail. If you request printed copies of the proxy materials by mail, you may vote by proxy by signing and returning the proxy card or voting instruction card. |

If you vote by telephone or via the Internet, please have your Notice or proxy card available. The control number appearing on your Notice or proxy card is necessary to process your vote. A telephone or Internet vote authorizes the named proxies in the same manner as if you marked, signed, and returned a proxy card by mail.

Church & Dwight Co. | 2024 Proxy Statement | 5 | |

| PROXY STATEMENT | ||

How You May Revoke or Change Your Vote

You have the power to change or revoke your proxy at any time before it is voted at the Annual Meeting as follows:

Stockholders of record.

We pay fees to our directors in accordance with the Amended and Restated Compensation Plan for Directors (as amended and restated, the(the “Compensation Plan for Directors”). Any fees payable to our directors under this planthe Compensation Plan for Directors may be deferred in accordance with our Deferred Compensation Plan for Directors, provided that a timely election is made by the director seeking such deferral. We also provide annual restricted stock units and stock option awards to our directors under the Amended and RestatedChurch & Dwight Co., 2022 Omnibus Equity Compensation Plan (the “Omnibus Equity Compensation Plan”). All of these arrangements are described in further detail below.

Compensation Plan for Directors. Our The Compensation Plan for Directors became effective as of Januarywas amended and restated in February 2023 and further amended and restated on November 1, 2015,2023 (as so amended and restated, the “Compensation Plan for Directors”) and provides for the payment of fee-based compensation (i.e., an annual retainer and any special assignment meeting fees) and annual equity grants to our directors other thanwho are not full-time employees of the CEO.Company or its affiliates. Special assignment meeting fees areof $2,000 per meeting may be paid in consideration for attendance at meetings with respect to certain non-scheduled activities and special projects requestedas determined by the Board. NoGovernance, Nominating & Corporate Responsibility Committee and cannot exceed $20,000 per special assignment committee member, including the chair of such committee. Mr. Winkleblack received special assignment meeting fees in 2023 which were paid in fiscal year 2017.December 2023. The annual retainer amount is pro-rated for any director with less than a full year of service.

The Compensation Plan for Directors provides each director with the choice of receiving his or her fee-based compensation (i) 100 percent in cash if that all fee-based compensation payable todirector has fully satisfied the Company’s Stock Ownership Guidelines for Directors, (ii) 50 percent in cash and 50 percent in shares of our common stock if specifically elected by a director annually be paid either 100%or (iii) 100 percent in shares of our common stock (the default method of payment), or 50% cash and 50% in shares of our common stock if specifically elected by a director.. For 2017, our2023, all directors made their electionelections for how to receive their fee-based compensation in December of 2016.2022. To determine the number of shares a director is entitled to receive under the plan,Compensation Plan for Directors, the annual retainer or special assignment meeting fee amount (as applicable) is divided by the closing price of a share of our common stock as reported on the NYSE on the applicable payment date.

Annual Equity Grants for Directors. The Compensation Plan for Directors provides that, unless otherwise established by our Boardbeginning in January 2023, non-employee directors will receive 50 percent of Directors, equitytheir Annual Equity Grant in the form of stock option awards and 50 percent in the form of restricted stock units (“RSUs”), in each case, granted under the 2022 Omnibus Equity Compensation Plan. These grants to our non-employee directors will be made annually on the same date each year on which we makefirst day of the first open trading window following the Company’s earnings release associated with the annual equity grants to our employees (which date occurs on the Monday falling most closely to the midpoint between the datesmeeting of our first and second quarter earnings releases).stockholders. A new director will receive his or her initial equity grant on the date such individual commences service with us as a director. In 2017, as in prior years, the annual equity grants were comprised of stock option awards. All shares underlying theThe stock options granted to non-employee directorswill vest in full on the earlier of (i) the third anniversary of the date of grant, or (ii) the third annual meeting of the Company’s stockholders following the date subjectof grant, provided that the director continues to serve on the director’s continued service on our Board of Directors.until such date. Upon any cessation of service due to death or disability, theall outstanding stock options, (toto the extent unvested)unvested, continue to vest and all unexercised options remain outstanding until the third anniversary of such death or disability (or earlier until expiration of the option term). For any directorWith respect to stock option awards, directors who retiresretire after servingservice on ourthe Board of Directors for at least six years the(“Retirement”), any stock options (to the extent unvested) will continue to vest and all unexercised stock options remain outstanding for the remainder of the option term. Stock optionsThe RSUs will vest in full on the first anniversary of the date of grant, provided that the director continues to our non-employee directors are granted underserve on the Omnibus Equity Compensation Plan with a ten-year term.Board until such date. Upon any cessation of service due to death or disability all unvested RSUs will vest in full and will be settled by the payment of underlying shares following vesting. Upon Retirement,100 percent of the RSUs will immediately vest. No non-employee director may receive more than one equity grant in any calendar year.

|

| |

|

Deferred Compensation Plan for Directors. The Deferred Compensation Plan for Directors provides an opportunity for our directors to defer payment of all or a portion of their respective director fees into a notional account until after termination of service. A director electing to defer payment must decide whether to receive the deferred payment in a lump sum or in annual installments over a period of up to ten10 years. A director must make any of the foregoing elections prior to the beginning of the calendar year for which the deferred fees are earned. Also, newly elected directors may make such election within 30 days of becoming a director. A director’s election is deemed to remain in effect with respect to the following year unless the director revokes or changes such election prior to the commencement of such following year. Following a termination of service, the director generally receives a number of shares of our common stock in accordance with his or her timely filed election,

Church & Dwight Co. | 2024 Proxy Statement | 35 | |

| CORPORATE GOVERNANCE | ||

either in a lump sum or in annual installments over a period of up to 10 years, equal to the number of notional shares then outstanding in the director’s deferred compensation account under the plan. On a change in control, any and all deferred accounts (including any account being paid in installments) will be immediately distributed. The number of notional shares represented by amounts in a participating director’s account is set forth below in the table captioned “Securities Ownership of Certain Beneficial Owners and Management” on page 28.Management.”

2023 Annual Compensation Changes. On November 1, 2017, the Governance & Nominating Committee, in consultationLimit for Directors. Consistent with the Compensation & Organization Committee, reviewed the compensation of our non-employee directors. As part of their review, the Committees consulted with Semler Brossy, the independent compensation consultant retained by the Compensation & Organization Committee. As part of its analysis of the compensation of our non-employee directors, Semler Brossy examined how the total compensation and each element of our non-employee director compensation program compared to the director compensation programs of our Peer Group identified and discussed in more detail on pages 35 and 36. The Governance & Nominating Committee targets the total compensation paid to our non-employee directors at a level that approximates the 50th percentile of the compensation paid to non-employee directors of the Peer Group. Based on its analysis, Semler Brossy concluded that the total compensation paid to our non-employee directors was below the median of the director compensation of the Peer Group. Based upon its review, the Governance & Nominating Committee recommended to the Board that the annual equity grant be increased from $120,000 to $130,000 effective January 1, 2018 to bring the total compensation paid to our non-employee directors closer to the median of the total compensation paid to directors of the Peer Group. In addition, on November 1, 2017, based on the recommendation of the Governance & Nominating Committee, the Board amendedmarket practice, the Compensation Plan for Directors effective asincorporates a maximum annual limit of January 1, 2018,$750,000 on the aggregate grant date value of equity and equity-based awards plus the aggregate amount of cash-based compensation granted to provide eachany non-employee director with the choice of receiving 100-percent of his/her fee-based compensation(whether elected to be paid in cash if that director has fully satisfied the Company’s Stock Ownership Guidelines for Directors. The default method of payment will continue to be 100% inor shares of our common stock and directors will continue to have the option to receive payment of their fee-based compensation 50% in cash and 50% in shares of our common stock. Such elections will be made in December of each year for continuing directors, and newly elected directors may make this election within 30 days of becomingor on a director.current or deferred basis).

The following table provides information regarding compensation forpaid to our non-employee directors in 2017.2023.

20172023 DIRECTOR COMPENSATION TABLE

|

|

|

| |||||||||||||||||||||||||||

Name | Fees Earned or | Stock | Option | All Other Compensation | Total | Fees Earned or Paid in Cash ($) | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1)(2) | Stock Awards ($)(1)(2) | Option Awards ($)(1)(2) | Option Awards ($)(1)(2) | All Other Compensation | All Other Compensation | Total ($) | Total ($) | |||||||||||||||

T. Rosie Albright |

| 110,000 | 120,000 |

| 230,000 | |||||||||||||||||||||||||

James R. Craigie | 136,000 | 120,000 | 60,000(3) | 452,000 | ||||||||||||||||||||||||||

| Bradlen S. Cashaw | ||||||||||||||||||||||||||||||

| James R. Craigie(3) | ||||||||||||||||||||||||||||||

Bradley C. Irwin |

| 110,000 | 120,000 |

| 230,000 | |||||||||||||||||||||||||

Robert D. LeBlanc | 71,000 | 120,000 |

| 262,000 | ||||||||||||||||||||||||||

Penry W. Price |

| 110,000 | 120,000 |

| 230,000 | |||||||||||||||||||||||||

| Susan G. Saideman | ||||||||||||||||||||||||||||||

Ravichandra K. Saligram |

| 110,000 | 120,000 |

| 230,000 | |||||||||||||||||||||||||

Robert K. Shearer | 64,000 | 120,000 |

| 248,000 | ||||||||||||||||||||||||||

Janet S. Vergis |

| 110,000 | 120,000 |

| 230,000 | |||||||||||||||||||||||||

Arthur B. Winkleblack | 62,500 | 120,000 |

| 245,000 | ||||||||||||||||||||||||||

| Arthur B. Winkleblack(4) | ||||||||||||||||||||||||||||||

| Laurie J. Yoler | ||||||||||||||||||||||||||||||

| (1) |

|

|

|

| |

|

consolidated financial statements in our Annual Report on Form 10-K for the fiscal year ended December 31, |

See “Compensation Plan for Directors” and “Deferred Compensation Plan for Directors” for information regarding the computation of the number of shares or notional shares provided to a director in payment of director fees. Three directors deferred payment of all or a portion of their |

(2) | At December 31, |

| (3) | Mr. Craigie retired from the Board on April 27, 2023. |

36 | Church & Dwight Co. | 2024 Proxy Statement | |

| CORPORATE GOVERNANCE | ||

| (4) |

|

|

STOCK OWNERSHIP GUIDELINES FOR DIRECTORS

Our non-employee directors are expected to have a level of equity ownership in the Company inIn order to ensure that their interests are aligned with the interests of our stockholders. Itstockholders, it is expected that each non-employee director will have, within five years from the date on which they join the Board, a number of shares having a value of at least five times the standard annual retainer (which is the annual retainer received by any director who is not a committee chair, the Lead Director or the Chairman). The annual retainer was $110,000$120,000 for 20172023 and the dollar value of shares required to be held by our directors who have served five or more years was $550,000$600,000 as of December 31, 2017.2023. The calculation of ownership includes includes:

shares or RSUs owned by the director (or members of his or her immediate family residing in the same household), ;

notional shares held for the account of the director in the Deferred Compensation Plan for Directors,Directors; and

shares held in a trust for which a director has shared voting or investment power.

No portion of the value of stock options are taken into account towards the directors stock ownership guidelines.

Until a non-employee director satisfies his or her stock ownership requirement, the director will be required to hold 50 percent of all shares of our common stock received upon the exercise of stock options, grants of stock, or upon lapse of the restrictions on restricted stock (in each case, net of any shares utilized to pay for the exercise price of an option and/or to satisfy tax withholding obligations). All of our non-employee directors who have been inare on track to meet their position forstock ownership guidelines within five years or more own enough shares to satisfy our guidelines.years.

In 2018, the Board adjusted the Stock Ownership Guidelines for Directors to include 60 percent of the in-the-money value of vested and unvested stock options to encourage non-employee directors to retain stock options over an extended period of time to reinforce further long-term alignment with stockholder interests.

Listed below are the names, ages and positions held by each of our executive officers and our Vice President, Controller and Chief Accounting Officer.

| Name | Age | Position | ||||

|

|

| ||||

|

| Executive Vice President, | ||||

|

| Executive Vice President | ||||

Patrick D. de Maynadier |

| Executive Vice President, General Counsel and Secretary | ||||

Richard A. Dierker |

| Executive Vice President, | ||||

Matthew T. Farrell |

| President and Chief Executive Officer | ||||

|

| Executive Vice President, Chief Human Resources Officer | ||||

Carlen Hooker | 53 | Executive Vice President, Chief Commercial Officer | ||||

Carlos G. Linares | 60 | Executive Vice President, Chief Technology Officer & Global New Product Innovation | ||||

Joseph J. Longo | 53 | Vice President, Controller and Chief Accounting Officer | ||||

|

| Executive Vice President, | ||||

Rick Spann |

| Executive Vice President, | ||||

|

|

|

|

|

|

| CORPORATE GOVERNANCE | ||

All executive officers serve at the discretion of our Board of Directors. Mr. KatzLongo serves at the discretion of our CEO.

Biographical information for Mr. Farrell appears under “Standing for“Director Nominees” under “Proposal 1: Election for Term Expiring in 2021” on page 7.of Directors.”

|

| |

|

Ms. BomhardMr. Bruno has been our Executive Vice President, Chief Marketing Officer and President – Consumer Domestic since April 2022, our Executive Vice President and Chief Marketing Officer sincefrom October 2021 to April 2022 and our Executive Vice President, International from January 2021 to September 2021. From January 2016 priorthrough January 2021, Mr. Bruno was the Company’s Vice President, International Marketing and Global Markets Group. From May 2015 through December 2015, Mr. Bruno was the Company’s General Manager, International Marketing and Global Markets Group. From July 2013 through April 2015, Mr. Bruno was the Company’s Director – Export. Prior to which shejoining the Company, Mr. Bruno held various positions with increasing responsibility at Johnson & Johnson, in its consumer, pharmaceutical and diagnostics business units. Since 2022, Mr. Bruno has served as General Manager, Europe since 2013. From 2005 to 2013, Ms. Bomhard serveda member of the board of directors of International Flavors & Fragrances, Inc., (“IFF”) an industry leader in food, beverage, scent, health and biosciences. Mr. Bruno will serve as a varietydirector of Marketing and General Management assignments at Energizer. Prior to Energizer, Ms. Bomhard worked for Wella AG and GlaxoSmithKlineIFF until its annual stockholders meeting in their marketing organizations.2024.

Mr. CugineBuchert has been our Executive Vice President Internationalof Strategy, M&A and Global New Products InnovationBusiness Partnerships since April 2022. From January 2016. From June 20142016 to December 2015, heMarch 2022, Mr. Buchert was Executiveour Vice President, Corporate Strategy and President, International Consumer Products, from July 2013M&A and prior to June 2014, hethat, has held various positions in the Company focused on M&A and strategy since 2006. During his tenure, Mr. Buchert was Executive Vice President, Global New Products Innovation, and President, International Consumer Products and, from May 2007 through June 2013, he served as our Executive Vice President, Global New Products Innovation. From October 2000 through May 2007,instrumental in the acquisition by the Company of 18 brands with an aggregate transaction value over $5.3 billion. Prior to joining the Company, Mr. CugineBuchert served in various capacities at Lafarge North America, Morgan Stanley and Columbia Capital where he held various positions of increasing responsibility. Mr. Buchert is a varietymember of management positions at the Company. Prior to that Mr. Cugine served in several capacities with FMC Corporation, including as Directorboard of Human Resources fordirectors of the Alkali, Peroxide, and Oxidant Chemical Divisions.Armand Products Company, a Church & Dwight joint venture.

Mr. de Maynadier has been our Executive Vice President, General Counsel and Secretary since December 2011. He served in a number of capacities for Hill-Rom Holdings, Inc. and its predecessor, Hillenbrand Industries, Inc., from January 2002 through December 2010, including Senior Vice President, General Counsel and Secretary and Vice President, General Counsel and Secretary. Previously, Mr. de Maynadier served as Executive Vice President, General Counsel and Secretary for CombiMatrix Corporation;Corporation, as President and Chief Executive Officer of SDI Investments, LLC, a spin-off of Sterling Diagnostic Imaging, Inc.;, and as Senior Vice President, General Counsel and Secretary of Sterling Diagnostic Imaging, Inc. Earlier in his career, Mr. de Maynadier was a corporate and securities Partner at the law firm Bracewell & Patterson, L.L.P.

Mr. Dierker has been our Executive Vice President, Chief Financial Officer and Head of Business Operations since April 2022 and our Executive Vice President and Chief Financial Officer sincefrom January 2016 prior to which he served asApril 2022. From 2012 to 2016 Mr. Dierker was our Vice President, Corporate Finance since 2012. Fromand from 2009 to 2012, Mr. Dierker led Supply Chain Finance as the Company’s Operations Controller. From 2008 to 2009, he held a senior financial management position at Alpharma, Inc., a leading international specialty pharmaceutical company. Prior to 2008, he held financial and business development management positions for Ingersoll-Rand Ltd, a major diversified industrial manufacturer.

Mr. KatzMs. Hemsey has been our Executive Vice President, Controller and Chief AccountingHuman Resources Officer since May 2007.April 2022 and our Executive Vice President, Global Human Resources from February 2020 to March 2022. From January 2003 through May 2007, Mr. KatzDecember 2017 to February 2020, Ms. Hemsey was our Controller,Vice President, Human Resources and from April 1993 throughOctober 2009 to December 2002, he2017 she was our Assistant Controller. Mr. KatzDirector Human Resources. Ms. Hemsey has been employed by us since August 2001 in various positions. Prior to Church & Dwight, Ms. Hemsey served in several capacities within the human resources function at Symrise.

Ms. Hooker has been our Executive Vice President, Chief Commercial Officer since April 2023 and our Vice President, Mass Channel from September 2019 to April 2023. Prior to joining Church & Dwight, Ms. Hooker

38 | Church & Dwight Co. | 2024 Proxy Statement | |

| CORPORATE GOVERNANCE | ||

was Vice President, Ferrero U.S.A. Inc., where she was responsible for $256M in gross sales across four departments at Walmart and Sam’s Club, from January 2019 to September 2019, Senior Vice President, Acosta, a large private-equity owned sales and marketing agency from January 2015 to January 2019, and Vice President, Sun Products Corp., where she was responsible for assessing, defining, and implementing, One Sun solutions at top retailers across all channels from September 2012 to December 2014. Previously, Ms. Hooker held various positions since 1986.with increasing responsibility at Tracfone Wireless Inc., Novartis United States, Pfizer Inc., the Nielsen Company and Kellogg Company.

Mr. Linares has been our Executive Vice President, Chief Technology Officer & Global New Product Innovation since April 2022 and our Executive Vice President, Global Research & Development sincefrom June 2017.2017 to April 2022. He currently serves on the board of trustees for TRI Princeton (Vice Chair) and the board of directors for The American Cleaning Institute. From 2012 to 2017, he served asMr. Linares was the Chief Technology Officer for Sun Products Corporation responsible for innovation, product(“Sun Products”) and packaging development, engineering, regulatory affairs, project management, and quality assurance. He also served as the Corporate Innovation Captain for company-wideSun Products’ innovation strategy. Prior to Sun Products, Corporation, Mr. Linares was the Senior Vice President of Global R&D, Quality and Regulatory, at Alberto Culver. Earlier in his career Mr. Linares gained significant R&D product development and innovation experience at Johnson & Johnson and Procter & Gamble.

Mr. Longo has been our Vice President, Controller and Chief Accounting Officer since September 2020. Prior to joining the Company, Mr. Longo, served as Vice President and Corporate Controller of Dorman Products Inc., a leading supplier of aftermarket auto parts, from December 2019 to June 2020. From January 2017 to August 2019, Mr. Longo served as Vice President and Corporate Controller of Pinnacle Foods Inc., a provider of branded consumer food products, and served at Tyco International Ltd. from October 2007 to January 2017 in roles across accounting, investor relations and business unit financial planning and analysis. He started his career at KPMG US LLP and has held senior accounting positions at Prudential Financial, Inc. and JP Morgan Chase & Co.

Mr. Read has been our Executive Vice President, President Consumer International & Specialty Products Division, since October 2021. Mr. Read has been with the Company since 2016 serving previously as the General Manager of the Canadian subsidiary. Mr. Read came to the Company from Aryzta AG where he served as Senior Vice President of Customer Development. Prior to that, Mr. Read held several leadership roles at Molson Coors including Global Vice President of Revenue Management, Senior Executive Vice President of Brands and Innovation for Molson Coors UK, and Vice President of Marketing for Coors Light and Portfolio Innovation at Molson Coors Canada. Mr. Read also held progressive brand and sales management roles at Reckitt Benckiser Canada.

Mr. Spann has been our Executive Vice President, Chief Supply Chain Officer since April 2022 and our Executive Vice President, Global Operations sincefrom May 2017.2017 to April 2022. He served in a number of capacities for Colgate-Palmolive Company from 1984 through 2017. His career there included assignments in Australia and Europe. His last role at Colgate was Vice President, Global Engineering where he led significant improvements in product and process development. Prior to that he was Vice President, Global Supply Chain for three different Colgate businesses;businesses: Personal Care, Home Care, and Toothbrush, where he had responsibility for operations in North America, Europe, Latin America, Asia, Australia, Africa and the Middle East. Mr. Spann started his career at Colgate-Palmolive Company as an Industrial Engineer and held positions of increasing responsibility in production management prior to his executive roles.

Mr. Tursi has been our Executive Vice President, North America Sales since January 2016. From June 2014 to December 2015, he was Executive Vice President, North America Sales and Retail Customer Marketing, and was Executive Vice President, North America Sales from May 2007 to June 2014. From July 2004 through May 2007, he was our Vice President, Domestic Consumer Sales. Prior to joining us, Mr. Tursi served as Vice President of Sales, Marketing and Customer Service of Spalding Sports Worldwide and its successor, Top-Flite Golf Co. from 1999 through 2004.

Ms. Zagorski has been our Executive Vice President, Global Human Resources since January 2017. From January 2011 to January 2017, Ms. Zagorski was Senior Vice President, Human Resources for the North American affiliate of BASF Corporation where she was responsible for the North American and Central American human resources functions, and from September 2007 to January 2011, Ms. Zagorski was Vice President Talent Development and Strategy at BASF Corporation. Prior to BASF Corporation, Ms. Zagorski held senior level global human resources positions at Mars, Incorporated, and Honeywell International, Inc. and previously worked in management consulting at KPMG.

Church & Dwight Co.| | 39 | ||

| SECURITIES OWNERSHIP | ||

SECURITIES OWNERSHIP OF CERTAIN BENEFICIALBENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information concerning ownership of our common stock as of March 6, 20182024 (unless otherwise noted), by (i) each stockholder that has indicated in public filings that the stockholder beneficially owns more than five percent of our common stock; (ii) each director and nominee for director; (iii) each current executive officer named in the “2023 Summary Compensation Table on pages 47;Table;” and (iv) all directors and executive officers as a group. Except as otherwise noted, each person listed below, either alone or together with members of such person’s family sharing the same household, had sole voting and investment power with respect to the shares listed next to such person’s name. None of the shares held by directors and executive officers included in the table are pledged as security.

|

|

|

|

|

Amount and Nature of | Notional | |

Name | Shares(2)(3) | Percent of | |

BlackRock, Inc.(4) | 19,423,114 | 8% | 0 |

State Street Corporation(5) | 15,306,306 | 6% | 0 |

The Vanguard Group(6) | 28,200,050 | 12% | 0 |

James R. Craigie(7) | 3,166,142 | 1% | 0 |

T. Rosie Albright | 78,938 | * | 71,547 |

Matthew T. Farrell(8) | 811,092 | * | 83,611 |

Bradley C. Irwin | 138,629 | * | 0 |

Robert D. LeBlanc(9) | 112,683 | * | 0 |

Penry W. Price | 78,171 | * | 0 |

Ravichandra K. Saligram(10) | 157,645 | * | 43,336 |

Robert K. Shearer | 78,874 | * | 18,295 |

Janet S. Vergis | 24,027 | * | 0 |

Arthur B. Winkleblack(11) | 108,235 | * | 0 |

Laurie J. Yoler | 0 | * | 0 |

Richard A. Dierker | 52,311 | * | 2,879 |

Louis H. Tursi, Jr. | 336,567 | * | 30,200 |

Carlos Linares | 3,344 | * | 444 |

Judy A. Zagorski | 926 | * | 752 |

All executive officers and directors as a group (19 persons) | 5,826,506 | 2% | 292,014 |

Amount and Nature of | Notional Shares in Deferred Compensation | |||||||||

| Name | Shares(2)(3)(4) | Percent of Class | ||||||||

BlackRock, Inc.(5) |

| 21,993,660 |

|

| 9.0 | % | 0 | |||

State Street Corporation(6) |

| 12,722,021 |

|

| 5.2 | % | 0 | |||

The Vanguard Group(7) |

| 30,264,910 |

|

| 12.4 | % | 0 | |||

Bradlen S. Cashaw |

| 1,023 |

|

|

| * | 2,530 | |||

Matthew T. Farrell(8) |

| 2,141,189 |

|

|

| * | 104,602 | |||

Bradley C. Irwin(9) |

| 76,329 |

|

|

| * | 0 | |||

Penry W. Price |

| 106,224 |

|

|

| * | 0 | |||

Susan G. Saideman |

| 16,309 |

|

|

| * | 0 | |||

Ravichandra K. Saligram(10) |

| 164,577 |

|

|

| * | 56,962 | |||

Robert K. Shearer(11) |

| 62,678 |

|

|

| * | 25,109 | |||

Janet S. Vergis |

| 73,817 |

|

|

| * | 0 | |||

Arthur B. Winkleblack(12) |

| 52,289 |

|

|

| * | 0 | |||

Laurie J. Yoler(13) |

| 42,462 |

|

|

| * | 0 | |||

Richard A. Dierker |

| 34,219 |

|

|

| * | 12,559 | |||

Barry A. Bruno |

| 75,197 |

|

|

| * | 135 | |||

Patrick D. de Maynadier(14) |

| 178,659 |

|

|

| * | 13,836 | |||

Carlos G. Linares |

| 110,859 |

|

|

| * | 20,906 | |||

All executive officers and directors as a group (20 persons) |

| 3,492,656 |

|

| 1.4 | % | 255,234 | |||

* | Less than one percent. |

(1) | Applicable percentage of ownership is based on |

40 | Church & Dwight Co. | 2024 Proxy Statement | |

| SECURITIES OWNERSHIP | ||

(2) | The shares listed in the “Shares” column do not include notional shares of our common stock credited to the account of directors under the Deferred Compensation Plan for Directors or credited to the account of executive officers under the Executive Deferred Compensation Plan. Notional shares do not represent actual shares, but represent interests equivalent in value to the fair market value of shares of our common stock; gains or losses in the interests are based upon gains or losses in the fair market value of our common stock. These notional shares are reflected in the table in the column labeled “Notional Shares in Deferred Compensation Plans.” Because notional shares do not represent actual shares, holders of notional share accounts are not entitled to vote with respect to the notional shares. |

| (3) | |||

|

| ||

|

| The numbers in this column include shares that are subject to stock options exercisable currently, or within 60 days of March 6, |

| (4) | The numbers in this column include shares that are issuable pursuant to RSUs which are subject to vesting and settlement conditions expected to occur within 60 days of March 6, 2024, as follows: Mr. Cashaw, 820 shares; Mr. Irwin, 820 shares; Mr. Price, 820 shares; Ms. Saideman, 820 shares; Mr. Saligram, 820 shares; Mr. Shearer, 820 shares; Ms. Vergis, 820 shares; Mr. Winkleblack, 820 shares; and Ms. Yoler, 820 shares; and all executive officers and directors as a group, 7,380 shares. |

| BlackRock, Inc. provided the following information in Amendment No. |

| State Street Corporation provided the following information in its Schedule 13G, filed with the SEC on |

| The Vanguard Group provided the following information in Amendment No. |

|

|

(8) | Mr. Farrell’s ownership includes |

(9) | Mr. |

(10) | Mr. Saligram’s ownership includes |

| (11) | Mr. Shearer’s ownership includes 29,108 shares of common stock held in a trust for which Mr. Shearer holds sole voting and sole investment power. |

Church & Dwight Co. | 2024 Proxy Statement

| 41 | |

| SECURITIES OWNERSHIP | ||

Mr. Winkleblack’s ownership includes |

| (13) | Ms. Yoler’s ownership of 8,342 shares of common stock held in a trust for which she shares voting and investment power. |

| (14) | Approximately 10,926 of the shares subject to the options included in this table are held in a trust pursuant to a marital settlement agreement for which Mr. de Maynadier disclaims beneficial ownership. Mr. de Maynadier’s ownership includes 9,137 shares of common stock held in a trust for which Mr. de Maynadier holds sole voting and investment power. |

42

| ||

Church & Dwight Co.| | | |

CERTAIN RELATIONSHIPS | ||

CERTAIN RELATIONSHIPS ANDAND RELATED TRANSACTIONS

REVIEW AND APPROVAL OF RELATED PERSON TRANSACTIONS

The Code of Conduct includes our policy regarding the review and approval of related person transactions. In accordance with the Code of Conduct, all related person transactions that meet the minimum threshold for disclosure in the proxy statement under the relevant SEC rules must be reported to and approved by the Audit Committee.

There were no disclosable related person transactions during 2017.2023.

Church & Dwight Co.| | 43 | ||

AUDIT COMMITTEE REPORT | |||

AUDIT COMMITTEECOMMITTEE REPORT

The Audit Committee assists the Board of Directors in its oversight of the integrity of Church & Dwight’s financial statements, compliance with legal and regulatory requirements, and the performance of the internal audit function. Management has primary responsibility for preparing the financial statements and for the financial reporting process. In addition, management has the responsibility to assess the effectiveness of Church & Dwight’s internal control over financial reporting. Deloitte & Touche LLP, Church & Dwight’s independent registered public accounting firm, is responsible for (i) expressing an opinion on the conformity of Church & Dwight’s audited financial statements to generally accepted accounting principles and on whether the financial statements present fairly in all material respects the financial position and results of operations and cash flows of Church & Dwight, and (ii) expressing an opinion on the effectiveness of Church & Dwight’s internal control over financial reporting.

In this context, the Audit Committee hereby reports as follows:

1. | The Audit Committee has reviewed and discussed with management and Deloitte & Touche LLP the audited financial statements and Deloitte & Touche LLP’s evaluation of Church & Dwight’s internal control over financial reporting. |

2. | The Audit Committee has discussed with Deloitte & Touche LLP the matters required to be discussed by the Public Company Accounting Oversight Board Standards |

3. | The Audit Committee has received the written disclosures and the letter from Deloitte & Touche LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding Deloitte & Touche LLP’s communications with the Audit Committee concerning independence and has discussed with Deloitte & Touche LLP that firm’s independence. |

Based on the review and discussion referred to in paragraphs (1) through (3) above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in Church & Dwight’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017,2023, for filing with the Securities and Exchange Commission.

Respectfully submitted,

Robert K. Shearer,Arthur B. Winkleblack, Chair

Bradley C. IrwinBradlen S. Cashaw

Penry W. Price

Janet S. VergisSusan G. Saideman

Robert K. Shearer

44

| ||

Church & Dwight Co.| | | |

FEES PAID | ||

FEES PAID TO INDEPENDENT REGISTEREDREGISTERED PUBLIC ACCOUNTING FIRM

Fees related to the 20172023 and 20162022 fiscal years payable to our independent registered public accounting firm, Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu Ltd., and their respective affiliates are as follows:

|

| |||||||||

| 2017 | 2016 | 2023 ($) | 2022 ($) | ||||||

Audit Fees | 3,185,225 | 2,920,750 |

| 4,095,000 |

|

| 3,898,750 |

| ||

Audit-Related Fees(1) | 614,925 | 640,716 |

| 306,041 |

|

| 354,041 |

| ||

Tax Fees(2) | 535,000 | 370,517 |

| 346,178 |

|

| 425,075 |

| ||

All Other Fees | 0 | 0 |

| — |

|

| — |

| ||

Total | 4,335,150 | 3,931,983 |

| 4,747,219 |

|

| 4,677,866 |

| ||

(1) | Audit-related fees primarily include services |

(2) | Tax fees include services for tax compliance and planning, assistance with tax audits from taxing authorities, and filing for tax incentives from government |

Church & Dwight Co.| | 45 | ||

PRE-APPROVAL OF AUDIT | |||

PRE-APPROVAL OF AUDIT AND PERMISSIBLE PERMISSIBLE NON-AUDIT SERVICES

The Audit Committee pre-approved all audit and non-audit services provided by Deloitte & Touche LLP during 20172023 in accordance with our policy described below.

The Audit Committee pre-approves all permitted non-audit services to be provided by our independent registered public accounting firm. However, the Audit Committee has delegated to Mr. Shearer, asthe Chair of the Audit Committee, authority to pre-approve permitted non-audit services, provided that any such pre-approved non-audit services are reported to the full Audit Committee at its next scheduled meeting.

46

| ||

Church & Dwight Co.| | | |

COMPENSATION DISCUSSION AND ANALYSIS | ||

COMPENSATION DISCUSSIONDISCUSSION AND ANALYSIS

In thisThis Compensation Discussion and Analysis we addressaddresses the compensation paid or awarded for 20172023 to our named executive officers, listed in the Summary Compensation Table that follows this discussion. We sometimes refer to thesewhich include our Chief Executive Officer (CEO), our Chief Financial Officer (CFO), and our three other most highly-compensated executive officers serving as our “namedof the end of the fiscal year. Our named executive officers (“NEO”) for the year ended December 31, 2023 were as follows:

Matthew T. Farrell | Chairman, President and Chief Executive Officer | |

Richard A. Dierker | Executive Vice President, Chief Financial Officer and Head of Business Operations | |

Barry A. Bruno | Executive Vice President, Chief Marketing Officer and President – Consumer Domestic | |

Patrick D. de Maynadier | Executive Vice President, General Counsel and Secretary | |

Carlos G. Linares | Executive Vice President, Chief Technology Officer & Global New Product Innovation |

EXECUTIVE SUMMARY

2023 Key Business Highlights and Strong Pay for Performance Alignment

2023 and 2022 Financial Results

The 2023 compensation of our named executive officers appropriately reflects and rewards their significant contributions to the Company’s performance in a year that demonstrated the strength of our brands, including our most recent acquisitions, innovative new product introductions, and our focus on execution. During 2023 and 2022 we delivered the following results for Net Sales, Gross Margin, Diluted EPS (as adjusted to exclude the cost of restricted shares issued for the Hero acquisition in both 2023 and 2022 and the discontinuation of business in Russia due to the Russia/Ukraine war in 2022), and Cash from Operations, which are used to measure performance (subject to additional adjustments) under our Annual Incentive Plan:

| (In millions, except gross margin and per share data) | 2023 | 2022 | ||||||

Net Sales |

| $5,868 |

|

| $5,376 |

| ||

Gross Margin |

| 44.1% |

|

| 41.9% |

| ||

Diluted EPS, as adjusted(1) |

| $3.17 |

|

| $1.72 |

| ||

Cash From Operations |

| $1,031 |

|

| $885 |

| ||

| (1) | 2023: The cost of restricted stock issued for the Hero acquisition ($0.12) 2022: The cost of restricted stock issued for the Hero acquisition ($0.03) and impact of the discontinuation of business in Russia due to the Russia/Ukraine war ($0.01) |

In our Annual Incentive Plan for 2023, we replaced the Gross Margin metric with a Relative Gross Margin metric and added a fifth metric, Strategic Initiatives. The effect of these financial results, and the Strategic Initiatives metric, on payouts under our Annual Incentive Plan are discussed in further detail below under the heading “Annual Incentive Plan.” In addition, the Company delivered total shareholder return (“TSR”), assuming dividends are reinvested, of 18.7 percent, following a decrease of 20.4 percent in TSR in 2022.

Church & Dwight Co. | 2024 Proxy Statement | 47 | |

| COMPENSATION DISCUSSION AND ANALYSIS | ||

Alignment to Strategy

The Compensation & Human Capital Committee, or the “Committee,” reviews and analyzes the executive compensation program each year for alignment with our business strategy and evolving market and governance practices for executive compensation. We believe that our current programs are aligned with the Company’s business priorities and designed to encourage shareholder value creation.

As part of the foregoing analysis, the Committee evaluates the relationship between pay and performance of our named executive officers. The analysis includes a review of the relationship between the compensation paid to the CEO and the other named executive officers and Company performance relative to roles having generally corresponding responsibilities within other similarly sized companies. For 2023, the analysis shows a strong link between Company pay and Company performance as such term is used in Item 402 of Regulation S-K.

COMPENSATION OBJECTIVESit relates to key operating measures.

We focus on the following objectives in making compensation determinations:

Provide compensation that is competitive in markets in which we compete for management talent. We refer to this objective as “competitive compensation.”

| • | Provide compensation that is competitive in markets in which we compete for management talent. We refer to this objective as “competitive compensation.” |

Condition the majority of a named executive officer’s compensation on a combination of short and long-term performance. We refer to this objective as “performance incentives.”

| • | Condition the majority of a named executive officer’s compensation on achievement of both short- and long-term performance. We refer to this objective as “performance incentives.” |

| • | Encourage the aggregation and maintenance of meaningful equity ownership, and the alignment of executive officer and stockholder interests as an incentive to increase stockholder value. We refer to this objective as “alignment with stockholder interests.” |

| • | Provide an incentive for long-term continued employment with us. We refer to this objective as “retention incentives.” |

Church & Dwight’s fiscal year 2023 results continued to be aligned with pay in the following ways:

Annual Incentive Plan: The Annual Incentive Plan aligns the interests of our executives and stockholders by achieving goals that support long-term stockholder return. The Annual Incentive Plan rating was set at 1.0, as projected EPS growth on a percentage basis was comparable to the average projected EPS growth of the Corporate Incentive Plan Rating Peer Group (as defined below). The Company achieved a plan rating of 1.71 based on 2023 actual performance, as adjusted. The Annual Incentive Plan payouts to our named executive officers for 2023 are discussed in further detail below under “2023 Compensation – Annual Incentive Plan.”

Long-Term Incentive: The Committee utilizes stock options as the primary form of long-term compensation. The Committee believes that stock options provide a strong incentive to increase stockholder value. We refer to this objective as “alignment with stockholder interests.”

Providevalue, since the value of stock options is directly dependent on the market performance of our common stock. The Committee believes that options are an incentiveappropriate vehicle for long-term continued employmentequity compensation because they directly reflect the stockholder experience, are straightforward to communicate, and provide value only if our stock price increases over time, which aligns our executives’ interests with us. We referthose of our stockholders in delivering TSR. In 2023, the Committee approved the addition of performance stock units and restricted stock units as long-term incentive (“LTI”) vehicles in order to more closely align with market practice and to provide our executives with alternative forms of incentives that complement our stock option awards. In deciding the weighting among LTI vehicles, the Committee benchmarked the Compensation Peer Group but also balanced the historical reliance on stock options in driving successful results and for 2023 75% of the long-term incentive awards for the executive officers consisted of stock options, 15% of performance stock units and 10% of restricted stock units. The performance stock units granted in 2023 are measured based on a relative ranking of total shareholder return over a three year performance period as we believe this objective as “retention incentives.”is the best output metric available.

48 | Church & Dwight Co. | 2024 Proxy Statement | |

| COMPENSATION DISCUSSION AND ANALYSIS | ||

2023 COMPENSATION

The principal components of 20172023 compensation that we paid to our named executive officers were designed to meet theseour compensation objectives are as follows:

Church & Dwight Co.| | 49 | ||

COMPENSATION DISCUSSION AND ANALYSIS | |||

STRONG COMPENSATION GOVERNANCE

Our executive compensation governance reflects best practices to protect and promote out stockholders’ interests.

| What We Do: |

| What We Do Not Do: | ||||||

☑ |

| |||||||

| Significant stock ownership and stock holding requirements are in place for senior executives. |

☒ |

| No gross-up payments to cover personal income taxes or excise taxes that pertain to executive or severance | ||||

| ☑ | A majority of our executive compensation is | ☒ | No hedging, pledging or short sales by our | |||||

| ☑ | Limited perquisites for executives. | ☒ | No repricing stock options without prior stockholder approval. | |||||

| ☑ | Appropriate balance between short-term and long-term compensation discourages short-term risk taking at the expense of long-term results. |

| No overlapping metrics between our annual incentives and our long-term incentives. | |||||

| ☑ | Our Annual Incentive | ☒ | No guaranteed annual incentives. | |||||

| ☑ | Engage in risk mitigation by including balanced performance metrics in our compensation programs, clawback provisions and oversight to identify risk. | |||||||

| ☑ | Change in control cash severance payments and vesting of stock options granted on or after July 30, 2019 require a “double trigger” before payment can be made or equity can vest (requiring a qualifying termination following a | |||||||

| ☑ | Our Compensation & | |||||||

| ☑ | Robust clawback policies that require the recoupment of excess incentive-based compensation paid to executive officers as a result of a material financial misstatement in accordance with the Dodd-Frank Act and NYSE rules and that permit the recoupment of compensation from a broader group of senior leaders in the case of material financial misstatements, cause conduct and violations of restrictive covenants. | |||||||

50

| Church & Dwight Co. | 2024 Proxy Statement | |||

|

|

| ||

DETERMINATION OF COMPETITIVE COMPENSATION

In making executive compensation decisions for 2017, the Compensation & Organization Committee, or the “Committee,” referenced data provided by Steven Hall to compare the compensation of our named executive officers to the compensation of executives of other similar-sized companies with generally corresponding responsibilities. The Committee referenced data from a group of companies (the “Peer Group”) and survey data from non-durable goods and consumer products companies to assist in decisions regarding the base pay, Annual Incentive Plan targets and long-term incentives. In providing comparative data regarding compensation of executives of the Peer Group, Steven Hall aged the data to January 1, 2017 using an update factor of three percent per annum.

COMPENSATION DISCUSSION AND ANALYSIS |

The Peer Group is a groupSay-On-Pay Vote and shareholder engagement

At the 2023 Annual Meeting of consumer packaged goods companies that have revenues inStockholders, we asked our stockholders to vote to approve, on an advisory basis, the range of approximately 50 – 200% of our revenues. Within this classification, the Committee referenced companies with similar distribution channels and with a significant focus on brand recognition. Prior to setting our 2017 compensation, the Committee reduced the Peer Group from 19 companies to 12 companies to eliminate companies the Committee believed were not aligned with the foregoing criteria. The change in the Peer Group reflects the removal of prior peer companies that have been reorganized or acquired and changes made to ensure that the Peer Group aligns more closely with the companies that we compete against. We believe there is a strong likelihood that the skills of our named executive officers are transferable among the companies in the revised Peer Group, so we would expect to compete with these companies for executive officer talent. For 2017, our Peer Group consisted of the following:

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Committee primarily utilizes data with respect to the Peer Group for our CEO and CFO. With respect to our other named executive officers, the Committee primarily uses survey data in determining compensation. The Committee also references Peer Group data in determining their compensation when there is a meaningful level of relevant data for those positions. When determining the compensation paid to Ms. Zagorski and Mr. Linares, each of whom joined the Company in 2017, the Committee also considered the market for executive officers in Global Human Resources and Global Research & Development, respectively, their skills and experience, responsibilities required in their respective roles and their respective compensation from their prior employers. The Committee approved the following for each of Ms. Zagorski and Mr. Linares:

| Mr. Linares | Ms. Zagorski |

Base Salary | $415,000 | $415,000 |

Target Bonus | 50% of Base Salary | 50% of Base Salary |

Annual Equity Payout Target | 92% of Base Salary | 92% of Base Salary |

One time Restricted Stock Award or Sign-on Bonus | 220,000 (Restricted Stock Award) | 410,000 (Sign-on Bonus) |

One time Stock Option Award | 382,000 | 250,000 |

In determining a 2017 competitive market guideline with respect to total direct compensation, namely base salary, Annual Incentive Plan targets and long-term incentives, the Committee referenced a level that approximates the 50th percentile of the Peer Group, or the survey companies, as applicable. However, the Committee did not follow this guideline rigidly, and departed from this general guideline, as described below. In addition, because a majority of our compensation is performance-based, actual cash compensation paid to our named executive officers, could further vary from that paidcommonly referred to as a Say-on-Pay vote. Our stockholders approved compensation to our named executive officers, with over 84% percent of votes cast in favor of our say-on-pay resolution. We value this positive endorsement by our stockholders of our executive compensation program. After soliciting input from and engaging with various major stockholders regarding our executive compensation program, the Compensation & Human Capital Committee assessed our compensation programs and found our current mix of performance metrics to be generally balanced and supportive of our pay-for-performance philosophy, consistent with the solid support expressed by our stockholders, and determined to further ensure that our compensation program is supportive of our pay-for-performance philosophy by adjusting our long-term incentive program to introduce restricted stock units and performance-based restricted stock units. We believe our programs are effectively designed, are working well, and are aligned with the interests of our stockholders. The Compensation & Human Capital Committee will continue to seek and consider stockholder feedback in the Peer Group orfuture.

2023 Executive Compensation Highlights

Redesign of Long-Term Incentive Compensation Program. In 2023 the survey companies, based on achievementCommittee evaluated the structure of our long-term incentive compensation program in the context of our compensation objectives and principles, including pay for performance targets.and alignment with stockholder interests:

In connection with this evaluation and in consideration of market practice and risk management, the Committee determined to alter its years-long practice of granting long-term incentives entirely in the form of stock options and instead determined that, beginning in 2023, long-term incentives would be granted as a mix of restricted stock units, performance stock units and stock options. For our named executive officers, the mix of awards in 2023 was 10% time-based restricted stock units, 15% performance stock units, and 75% stock options. The Committee believes that one of the reasons for the Company’s outperformance over the long term is due to the long-term incentive award significant reliance on stock options.

Performance stock units granted in 2023 vest entirely based on the achievement of a relative total shareholder return metric over a three-year performance period, reflecting our core principle of alignment with stockholder interests.

Changes to Our Annual Incentive Plan. In addition to reviewing and making changes to our long-term incentive program in 2023, our Committee reviewed our Annual Incentive Plan, which has been in place since 2004, and determined to make the following changes beginning in 2023:

Introduced a “Strategic Initiatives” metric, focused on sustainability and long-term growth, consistent with market practice and our compensation principles, with each of the five metrics equally weighted (i.e., 20% per metric); and

In light of the supply chain disruptions and inflation that are likely to persist and impact how we evaluate our annual gross margin performance, the Committee determined to replace the “Gross Margin” metric with a “Relative Gross Margin” metric, which allows us to consider our performance as a percentile ranking within our Performance Peer Group (as discussed further below), and therefore serves as a more accurate reflection of our performance.

Church & Dwight Co.| | 51 | ||

COMPENSATION DISCUSSION AND ANALYSIS | |||

COMPONENTS OF OUR EXECUTIVE COMPENSATION PROGRAM

MIX OFOF PAY

On average,For 2023, approximately 83%88 percent of the CEO’s target compensation and, 62%on average 71 percent of the other named executive officers’ target compensation iswas variable, based on Company and individual performance. Variable compensation consists of the target Annual Incentive Plan payout, target Profit Sharing amount and the target value of stock optionslong-term incentive awards granted. The percentages below are calculated by dividing each compensation element by target total compensation, which consists of base salary, target Annual Incentive Plan compensation, target Profit Sharing amount plus variable compensation.target long-term incentives.

In 2017,For 2023, the CFO and Mr. Tursi each receivedCommittee approved base salary increases of approximately 3%, which was consistent with market increases2 percent for this period. Based on marketplace comparisons, our CEO did not receive aall the named executive officers to further align base salary increase. Ms. Zagorski and Mr. Linares each began employmentsalaries with the Companycorresponding median levels of our Compensation Peer Group and industry survey data. The base salaries of our named executive officers as in 2017, and their salaries were approved byeffect as of December 31, 2023 are set forth in the Compensation & Organization Committee at the time they were hired.table below:

Named Executive Officer | 2023 Base Salary ($) | |||

Matthew T. Farrell | 1,189,800 | |||

Richard A. Dierker | 698,700 | |||

Patrick D. de Maynadier | 510,500 | |||

Barry A. Bruno | 499,800 | |||

Carlos G. Linares | 494,700 | |||

Compensation of each of our named executive officers is set forth on the “2017“2023 Summary Compensation Table” on pages 47.Table.”

52 | Church & Dwight Co. | 2024 Proxy Statement | |

| COMPENSATION DISCUSSION AND ANALYSIS | ||

ANNUAL INCENTIVE PLAN

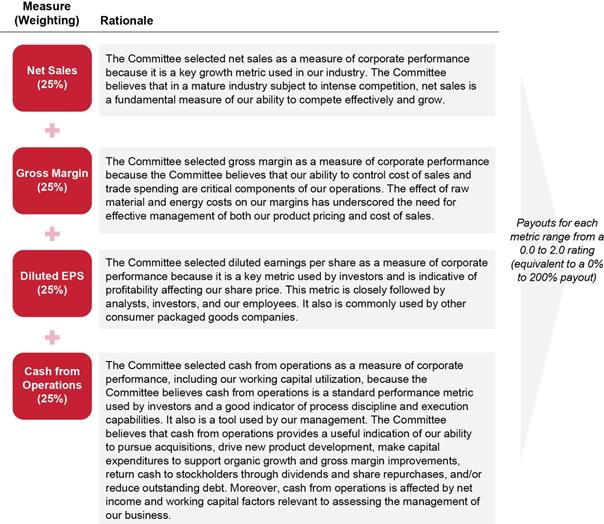

Our Annual Incentive Plan utilizes five equally weighted metrics, namely: Net Sales, Relative Gross Margin, Diluted EPS, Cash from Operations and Strategic Initiatives. The table below summarizes the reasons the Committee utilizes these metrics for our Annual Incentive Plan.

The principal objective of the Annual Incentive Plan is to align executive and stockholder interests by providing an incentive to our named executive officers to achieve annual performance goals that also support long-term

Church & Dwight Co. | 2024 Proxy Statement | 53 | |

| COMPENSATION DISCUSSION AND ANALYSIS | ||

stockholder return. The performance goals for the financial metrics are established each year to reflect specific objectives set in our annual budget. For the Strategic Initiatives metric, the Committee establishes specific objective goals under each category and measures the attainment of such goals using a detailed scorecard approach. The Committee also considers competitive factors, including competitive market data for total cash compensation, which includes salary and target annual incentive bonus opportunities, in determining the amount of annual incentive award opportunities for our named executive officers.

To more accurately reflect the operating performance of our business, the Committee has approved adjustment principles to our reported financial results for the Annual Incentive Plan. Generally, these adjustments are intended to exclude one-time or unusual items and may have either a favorable or unfavorable impact to the payout on the Annual Incentive Plan. Examples of common adjustments include the elimination of the effect of foreign exchange rates that differed from budgeted amounts and the impact of unplanned acquisitions and divestitures. The actual adjustments that apply can vary from year to year and depend on the one-time or unusual events occurring within the year.

As noted above,below, in structuring total direct compensation for our named executive officers, we have referenced the median level50th percentile of direct compensation of the Compensation Peer Group and survey data. This median has influenced our annual incentive compensation target award levels, although we have from time to time, set target payouts above the median level when we believed that our planned performance was well ahead of the targets of a subset of non-food companies in our Performance Peer Group targets.(the “Corporate Incentive Plan Rating Peer Group”, as described further below).